Las Vegas Business Startup Guide

There are a ton of decisions to make when you start a business in Las Vegas or anywhere in Clark County, NV. Find out everything you need to think about before you start your new business.

Introduction

Starting a business in Las Vegas, Nevada can be extraordinarily rewarding. We benefit from tourism, a pleasant climate, and low tax environment compared to many major cities in the western United States.

We’ll discuss how to start a business in Las Vegas by explaining how to:

- Choose a business idea.

- Plan for success.

- Choose a business structure.

- Name your business.

- Register, get licenses and business permits.

- Prepare to open your business.

- Start marketing your business.

Get ready to learn how to start a business in Las Vegas.

Step 1. Choose A Business Idea

There are all kinds of small businesses you can start. According to the City of Las Vegas community dashboard, some of the most common types of small businesses in Las Vegas include:

- Professional and Business Services: 3,536

- Education and Health Services: 3,521

- Trade, Transportation, and Utilities: 3,126

- Financial Activities: 2,383

- Other Services: 2,139

- Unclassified: 1,898

- Leisure and Hospitality: 1,807

- Construction: 1,038

- Information: 425

- Manufacturing: 326

- Mining: 33

You’ll want to look at your skill set, interests, financial situation, and the industry growth to decide which of these fields you would like to enter.

While you might be tempted to enter into the fields with less competition, they often have more barriers to entry and higher startup costs.

You can take an aptitude and interest test to help get business ideas, then compare them to the Bureau of Labor Statistics high-paying and in-demand fields.

You can read my blogs about different business ideas on UpFlip to learn about the startup costs, earnings, and check out interviews with business owners.

If the field requires special education or licensing requirements, you may need to partner with someone who meets the requirements or pursue an education.

Step 2. Plan For Success.

You’ll want to perform market research to establish whether your business idea is a good fit for the Las Vegas area. Then you’ll want to create a business plan.

Perform Market Research

You’ll want to research the Las Vegas area to identify:

- Number of potential customers: Maximum is 2.2 million locals, 20,000 businesses, or 41.7 million tourists. You’ll also want to define the demographics of your potential customers to help with marketing later.

- Number of competitors: There could be up to 3,600 competing businesses.

- Total addressable market (TAM): The potential revenue if you achieve 100% of the market.

- Average revenue per company: Divide TAM by number of companies to get an idea of what the average company makes.

- Opportunities: Research competitors and look for ways to differentiate yourself from them.

- Pricing: Make sure you understand how much competitors charge and how to make your value more attractive. You don’t have to compete on price.

I like to use IBIS World to get information on the competitors and census.gov to gather information.

Create A Business Plan

You’ll want to create a business plan to help guide your business decisions, pursue funding, and prepare for the future. You should include:

- Business Plan Cover Page

- Table of Contents

- Executive Summary

- Company Description

- Description of Products and Services

- Marketing Plan

- SWOT Analysis

- Competitor Data

- Competitive Analysis

- Marketing Expenses Strategy

- Pricing Strategy

- Distribution Channel Assessment

- Operational Plan

- Management and Organizational Strategy

- Financial Statements and/or Financial Projections

- Funding Request

Check out my UpFlip blog about how to write a business plan, or contact us for a free 30-minute consultation.

Step 3. Choose a Business Structure

You’ll want to choose a business structure. Most business owners choose either a limited liability company (LLC) or a corporation to protect against personal liability. There are other options like sole proprietorships and partnerships. You can learn about the different options at Nevada Silverflume.

An LLC offers the most tax options and protects you against lawsuits against your company and your company against your lawsuits. It has more protections than a sole proprietorship and less than a corporation, plus you can’t sell stock.

A corporation has taxation both on corporate income and personal income. It offers the most legal protection, allows you to sell stock, and has the most compliance issues.

Nevada allows people to start a sole proprietorship for free until they make a certain amount of revenue. You can find the fee waiver application here.

Make sure to talk to a licensed attorney to help you decide on the best option for your goals. Many organizations were required to file a Business Ownership Information with FinCen, but that no longer applies to domestically owned businesses.

Step 4. Name Your Business

You’ll want to consider business name ideas. Good business names are unique, available, and help people understand what you do.

You might want to include words that refer to what you do, but Nevada has some restrictions on words you have to include or should not include without prior approval.

When naming an LLC, NRS 86.171 require you to include one of the following terms in your name "Limited-Liability Company," "Limited Liability Company," "Limited Company," or "Limited" or the abbreviations "Ltd.," "L.L.C.," "L.C.," "LLC" or "LC." The word "Company" may be abbreviated as "Co.".

Meanwhile, NRS 78.035 requires a corporation to include “Incorporated,” “Limited,” “Inc.,” “Ltd.,” “Company,” “Co.,” “Corporation,” “Corp.,” or other word which identifies it as not being a natural person.

You’ll want to check the business name availability using the Nevada Business Search. You'll also want to verify the domain name and the social media handles are available. Assuming the name is available you can then register as the business entity you have chosen.

You’ll want a “doing business as (DBA)” if you are conducting business under a different name than the business entity’s legal name. This is most common with partnerships and sole proprietors, but other organizations may need it as well.

Step 5. Register, Get Licenses And Permits

You’ll need to get the appropriate licensing for the type of company you want to start. The best way to do it is to go onto the NV SilverFlume business registration portal.

It will walk you through setup for each type of entity. As I grow this website, I will provide a walkthrough for each type of entity.

You’ll need:

- State Business License

- County and City Licenses

- Specialized Permits

- Employer Identification Number

- Tax Permits

State Business License

This is your LLC, corporation, or other business entity. We’ve provided links for this already in previous sections. Each one is a little different.

County And City Licenses

Las Vegas has a weird scenario for local licensing. There are six jurisdictions in Clark County:

- Unincorporated Clark County: Anywhere not included in one of the other jurisdictions. Any of the small townships that are not well known are included in this area. It’s the largest portion of Clark County with nearly 1 million people.

- City of Las Vegas: A relatively small part of the greater Las Vegas Metropolitan area. A Las Vegas address does not mean you are part of this jurisdiction because it is used as a blanket term for

- City of Henderson: If you have a Henderson address, you’ll likely be here.

- City of North Las Vegas: Locations with a North Las Vegas address will likely be here.

- Boulder City: Boulder City is south of the Las Vegas metropolitan area on the 95 and has it’s own business licensing.

- City of Mesquite: If you serve customers in Mesquite, NV you will also need their business licensing.

You can use the Clark County Maps Search to find your jurisdiction based on your address. Mobile service businesses may need to be registered each of the jurisdictions they work in.

This can get expensive so you may want to limit your service areas to unincorporated Clark County and one of the other jurisdiction until you become more established.

Specialized Permits

Many companies will need other licensing or permits like the health inspections, fire inspections, code inspections, contractors licensing, sheriffs cards, liquor licenses, and other requirements that vary by industry.

Employer Identification Number (EIN)

An employer identification number is issued by the Internal Revenue Service and is used to tie payroll taxes to an employer. You’ll need one for any type of business that has employees or has personal liability protection.

In addition, they are used when opening business bank accounts, applying for loans, and other activities.

Tax Permits

You'll need to register your business with the Nevada Department of Taxation (NDT). The SilverFlume portal will take you link to the application when you register your business as well. This is where you will be able to sign up to collect and pay taxes including Sales and Use, Consumer Use, Cigarette & Other Tobacco Products, Liquor and Live Entertainment Tax.

Step 6. Prepare To Open Your Business

Opening your Las Vegas business will require a number of steps including:

- Choose a business location.

- Get a business bank account.

- Get business insurance.

- Get equipment and inventory.

- Hire employees.

We'll discuss how each of these helps you start a business in Las Vegas, NV.

Choose A Business Location

You'll want to decide whether you will start a home business or get a commercial space. Let's look at the pros and cons of each.

Home businesses normally have higher profit margins, but many home owners associations do not allow them if there will be lots of traffic or deliveries. You'll be able to deduct part of your home expenses from your taxes, but that also means you can't escape work by going home. Home businesses may also have more distractions than having a separate office, retail space, or warehouse.

On the other hand, getting a separate business location will require working with a commercial real estate agent. You'll want to establish how much space you'll need, what area of town you want to be in, what businesses you'll want to be nearby and ones you don't, your budget, and what you are going to need to do to prepare the space for your use case.

Get A Business Bank Account

You'll want to open a business bank account to keep your personal expenses and your business expenses separate. This will help you build a relationship before you seek funding and help simplify your tax filing. Some of the local banks and credit unions that are based in Las Vegas include:

- America First Credit Union: A credit union with branches in Las Vegas and surrounding areas.

- Bank of Nevada: Part of the Western Alliance Bank, it focuses on business banking and operates as a full-service bank.

- Beal Bank USA: A bank headquartered in Las Vegas that offers savings products.

- Clark County Credit Union: A local credit union serving Clark County.

- First Security Bank of Nevada: A state-chartered bank based in Nevada.

- Meadows Bank: A community bank headquartered in Las Vegas.

- Nevada State Bank: A regional bank with a focus on serving Nevada.

- Silver State Schools Credit Union: A credit union serving the educational community in Nevada.

While you can use major banks like Bank of America, Chase, and Wells Fargo, they have many more customers and are less likely to prioritize loans for you than local banks who have been working with you for a longer time. I would recommend using the major banks if you have plans to expand beyond Nevada though.

Get Business Insurance

Business insurance a crucial part of protecting your business. Each business will need different types of insurance depending on their needs, but most businesses will need:

- Business liability insurance

- Property insurance

- Commercial vehicle insurance

- Business interruption insurance

- Cybersecurity insurance

- Workers' compensation insurance (if you have employees)

- Unemployment insurance (if you have employees)

I typically recommend applying through Simply Business because they compare rates across major insurance companies to provide the best rate.

Get Equipment & Inventory

Most small businesses will need at least some equipment and inventory. At a minimum you'll need a desk, chairs, computer, vehicle phone, and printer. Depending on your industry, you'll need tools of your trade and products to sell.

Ecommerce stores can reduce their inventory by using print-on-demand or dropshipping features to help reduce your startup costs.

Hire Employee (Optional)

Many businesses will need people to help them serve their customers. There are a lot of hats to wear as a business owner and it is hard for one person to do everything. You will want to consider hiring the following roles as employees or contractors.

- Legal representative

- Bookkeeper/Accountant

- Marketing professionals

- Human resources

- Customer service

You can hire remote workers through freelancing sites on a contract basis, but if the job role is central to how the company makes money you should classify them as employees and pay their payroll tax to avoid getting hit with fines of up to $5,000 per employee for misclassification of employees.

Step 7. Start Marketing Your Business.

Marketing your business is crucial to getting customers. There's a lot that goes into marketing your business. You'll need to:

- Create a marketing plan.

- Create a marketing budget.

- Get customer relationship management software.

- Create a website.

- Create social media handles.

- Setup analytics.

- Set up a Google Business Profile.

- Set up Google Search Console.

- Set up marketing funnels.

- Create and share content.

- Create physical marketing.

- Implement your marketing strategy.

Let's look at how each of these helps you start a business in Las Vegas.

Create A Marketing Plan

The first thing you'll want to do is create a marketing plan if you didn't during the business plan stage. You'll want to define your products or services, pricing, where you'll sell them, and how you'll promote them.

You'll want to detail the customer journey as well as possible. Typically it takes approximately at least 6-12 touch points before someone is willing to buy from you. That means you'll need to use strategies like content creation, email marketing , and using retargeting ads to help potential customers progress from being unaware of your company to a customer, and promoting your company to their friends.

You'll also want to create brand guide lines like colors, font, tone of voice, acceptable language, and responses to customer requests.

Create A Marketing Budget.

You'll want to create a marketing budget to help you track how much you should spend on marketing and then compare your results to industry standards and your budget.

The best way to create a marketing budget is to start with how much you want to make after taxes. Let's assume that you want to make $100,000 and your net profit margin is 8.67% which is the average of publicly held companies as of January 2025.

You'll want to divide the $100,000 by the profit margin to get the revenue, which would be $1,153,402.54.

Then you'll want to assume that you need to spend 8% of the revenue on marketing to reach your goals. That's $92,272.20 per year, or $7,689.35 per month.

I know that sounds like a lot, but you don't have to start off with that much. In fact, you shouldn't because you're likely going to need 3-5 employees to reach that goal. Just plan to reach that level.

For best results, you should assume you need $600 to $1,000 monthly for each channel you are running ads on. In addition, you'll want an approximately equal amount to go to the content creation, marketing systems, and outsourcing.

That's why most business owners only start with Google Ads and expand organically before adding other ad networks.

Get Customer Relationship Management (CRM) Software.

Small businesses need a way to manage their customer interactions. There is CRM software for most industries that is focused on providing easy solutions for things like:

- Providing estimates

- Tracking emails and phone calls

- Providing invoices

- Notifying customers when someone is on the way

- Collecting payments

- Requesting reviews

For service businesses I personally prefer Housecall Pro because it is intuitive to use unlike many of the competitors. I have also used Monday.com, Clickup, Jobber, Hubspot, and Salesforce. Unless you need a more complicated CRM, go with the one that is most intuitive to you.

Create A Website

You'll want a website to showcase your brand, offerings, and help customers conduct business. At the minimum you should have a home page, service pages, contact page, legal notice, and privacy page. It's also good to have a blog to help with search engine optimization and providing useful content to your potential customers.

There are numerous easy website builders. Most people prefer WordPress, but I have used Shopify, Wix, GoDaddy, and Ionos as well. Each has their pros and cons. I think Wix is the easiest to use though.

Create Social Media Handles

You'll want to create social media handles on each of the major social media platforms including:

- TikTok

- YouTube

- X

There are other profiles you may want to create depending on your business model and target market but start with those ones. You'll want to make sure your handle, cover photo, and banner are the same on all of them. Also add your website link and other information. You want to make sure the profile information is completely filled out and consistent across profiles.

Set Up Analytics

You'll want to connect analytics to your website. Most people connect at least Google Analytics and Facebook Pixel to their websites so they can use the analytics to retarget on Facebook and Instagram as well as Google Ads. Basic setup just requires adding some code to your website. It's pretty easy, but more advanced tracking may be a challenge for novices.

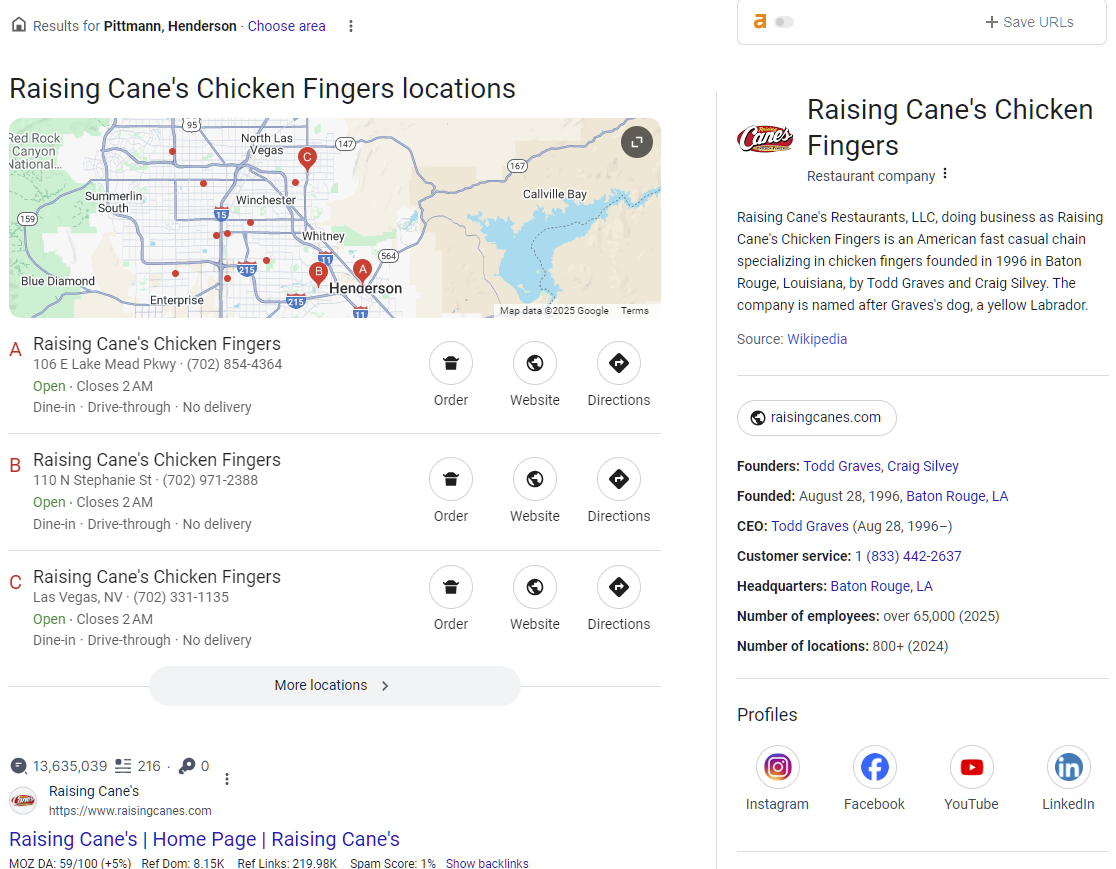

Set Up Google Business Profile.

Google Business Profile is a critical part of the marketing for any local business. It showcases your location, business information, social media profiles, reviews, and other information to help potential customers get a better understanding of your business.

The picture is an example of a good Google Business Profile.

Set Up Google Search Console.

Google Search Console is a webmaster tool that you can use to submit your website to Google to request indexing. It also tells you what keywords your website is ranking for and if there are errors on your website. You'll definitely want to setup one for purposes of managing your digital footprint.

Set Up Marketing Automation

Marketing automations are processes that your systems do automatically to help improve the customer experience. First you'll need to consider what the customer will experience and map out their path. When someone needs an HVAC technician they'll normally:

- Search something like my AC isn't working.

- Call the top rated suggestion.

- Provide their name, address, phone number, and a description of the problem.

- Wait for technician to get to their house.

- Greet technician.

- Approve the solution or reject it and ask for other quotes.

- Pay.

- Potentially provide a review.

In this example there's opportunities to provide better service to the customer through automations.

- You use SEO to help your business show up higher in the rankings.

- Always answer the phone.

- Employee ads the information into the CRM system. The CRM automatically sends a text message confirming the appointment.

- When the technician is about to head to the customer's house, they mark on the way and the CRM notifies the customer with a message like" (technician name) is on the way to your house. They'll be there in approximately X minutes."

- Technician greets the customer by name.

- Technician explains what is wrong, adds the estimate to the CRM, and provides the estimate to customer, who approves or rejects it.

- The technician completes the repair and asks the CRM to generate the invoice, which they then provide to the customer, who pays.

- Upon completion of the job and receipt of payment, the CRM sends a text message that says something similar to: (Customer name), Thank you for choosing (Company name ) to handle your HVAC repair. We rely on customer reviews to help drive business. We'd be greatly appreciative if you would take a couple minutes to fill out your review here (Insert link)."

All the CRM steps need to be set up to make them work as intended, but they create better customer service.

Create And Share Content.

You'll want to create blogs and videos about your field. They are useful for helping customers and employees understand your processes. You should be sharing them on your website and social media to help get your business name in front of more people.

One of the best ways to create and share content is to create long form videos using 30 second bits for each topic in the video, then repurposing them for shorts and blogs. This strategy makes it where you can

Create Physical Marketing.

While digital marketing helps get your business in front of people on the internet, you still need to use physical marketing as well. You'll want signs, business cards, uniforms, mailers, and door hangers to help market your business. Make sure that everything goes well together to help people recognize your brand just from seeing the colors.

Implement Your Marketing Strategy.

Marketing will be an ongoing effort. You'll want to create new content regularly and share it with your following. Plus you'll want to optimize your website and ads based on the information you get from analytics. Marketing can take a lot of work but it is beneficial and often makes the difference between a successful business and failed business.

FAQ

The next sections will answer common questions about starting a business in Las Vegas, NV.

How Much Does It Cost To Start A Business In Las Vegas NV?

It costs at least $1,500 to start a business properly. You should expect the costs to look like the numbers below.

- Business Structure: $10 to $3,000+

- Licenses and Permits: $150 to $25,000+

- Location: $0 to $1 billion (home-based to strip casino)

- Insurance: $1,000+

- Equipment and Inventory: $1,000+

- Software: $100 to $10,000+ for first year

- Operational Costs: $18,000+ for 3 months to a year.

According to Shopify, most business owners need $40,000 to start a small business and successfully operate for the first full year.

How To Start A Business In Las Vegas With No Money

To start a business in Las Vegas with no money you'll need to be creative. Some of the strategies you'll want to use include:

- Make sure you have another source of income.

- Apply for the free sole proprietorship with a DBA: $10

- Use a home office.

- Start a business that does not require permits, business insurance, and inventory.

- Use as much free software as possible.

- Don't hire employees.

- Reinvest the profits to help get to the ideal startup costs.

What Is The Easiest Business To Start In Las Vegas?

The easiest type of business to start in Las Vegas depends on your skillset, but they normally are one of three industries:

- Rideshare Business: Driving for Uber or other rideshare companies are good cash flow businesses with low startup costs, but not very profitable.

- Cleaning Business: You already have everything you need to start a cleaning business in Las Vegas so it is really easy.

- Online Business: You can start any kind of online business for fairly inexpensive. Using freelance sites like Upwork are low cost and can help you get clients.

While each of these businesses are fairly easy to start, you'll need to invest in better software and business systems as you grow.

Request A Free Consultation

Now you understand the basics of how to start a business in Las Vegas, NV. Reach out if you'd like help with your business planning, marketing, or finding reliable professionals to help you succeed.

Get in touch

Telephone: 702-335-7191

E-mail: Brandon@howtostartabusinessinlasvegasnv.com

Address: 989 Sable Chase PL, Henderson, 89011, Nevada, United States of America

©2025 Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.